Efficiency and equality and the role of government dse

在現代社會,效率和公平成為了許多政策制定者和公民關注的焦點。效率代表著如何在最少的時間和成本內達到最大的生產力和效益;而公平則是指每個人都能夠平等地享受社會資源和福利。然而,實現效率和公平之間往往存在矛盾,因為追求效率可能會導致資源分配不公平,而強調公平可能會降低效率。

政府在這個方程式中扮演著至關重要的角色。政府的政策和行動可以促進效率和公平的達成,但同時也需要考慮到這兩者之間的平衡。政府可以通過設定規則、提供資源、培育創新等方式來推動效率和公平的實現。此外,政府還可以通過紓解貧困、提供公共服務、建立社會保障制度等方式來實現公平,從而減少社會不平等和貧富差距。

在這篇文章中,我們將探討效率、公平和政府的角色之間的關係。我們將討論政府在推動效率和公平方面所採取的策略,以及這些策略的優缺點。我們還將探討政府在實現效率和公平之間的平衡方面所面臨的挑戰,以及可能的解決方案。最後,我們將總結討論,探討政府在效率和公平之間達成平衡的重要性,以及未來政府應該如何在這個方面發揮作用。

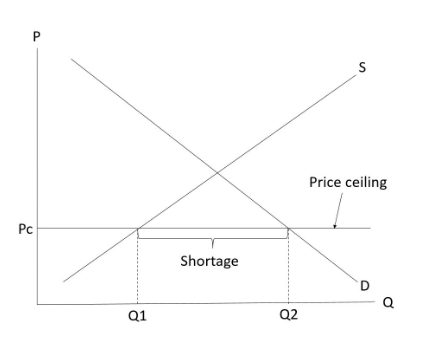

Price ceiling

-A maximum price allowed by the government/by law.

-普通商家自己將個價錢set係equilibrium下面唔算price ceiling,但同樣會出現shortage,其影響同price ceiling一樣。

-Effective only when it is imposed below the equilibrium price.

-When the price ceiling is set above the equilibrium (i.e., ineffective), price and quantity transacted will remain at the equilibrium level.

-Example: Rent control

|

Price |

Pc |

|

Quantity transacted |

Q1 |

|

Total expenditure/revenue |

Pc x Q1 |

Point to note

Total expenditure/revenue must drop under an effective price ceiling as both price and quantity transacted decrease.

Summary on the effects of an effective price ceiling

-Price↓

-Quantity transacted↓

-Total expenditure/revenue↓

-Emergence of shortage (excess demand)

Ways to deal with a shortage resulted from the imposition of a price ceiling

-Non-price competition

-Examples: Drawing lots/First come-first serve

-Price competition

-Examples: Imposing extra fees such as entrance fees (sellers to buyers)

-Black market

-係黑市賣嘅嘢會比外面貴,價高者得。

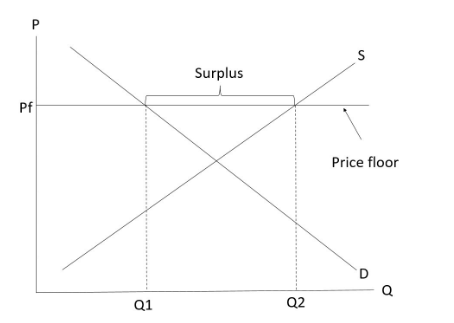

Price floor

-A minimum price allowed by the government/by law.

–普通商家自己將個價錢set係equilibrium上面唔算price floor,但同樣會出現surplus,其影響同price floor一樣。

-Effective only when it is imposed above the equilibrium price.

-When the price floor is set below the equilibrium (i.e., ineffective), price and quantity transacted will remain at the equilibrium level.

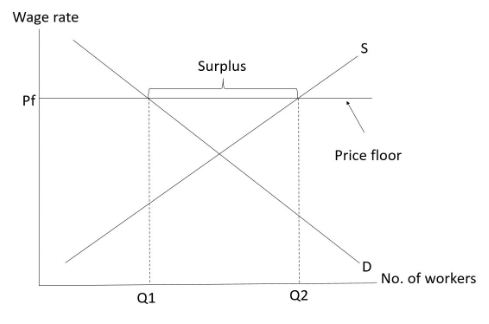

-Example: Minimum wage 最低工資 **************

|

Price |

Pf |

|

Quantity transacted |

Q1 |

|

Total expenditure/revenue |

Pf x Q1 |

Point to note

The effect on total expenditure/revenue due to a fall in price (caused by an effective price floor) should be uncertain, depending on the elasticity of demand.

Labour market under minimum wage (an effective price floor)

Point to note

-係最低工資之下,有surplus嘅係workers,即係太多workers請唔曬,唔係有shortage

Summary on the effects of an effective price ceiling

-Price↑

-Quantity transacted↓

-Total expenditure/revenue ?

-Emergence of surplus (excess supply)

Ways to deal with a surplus resulted from the imposition of a price floor

-Non-price competition

–Non-price competition

-Examples: Providing free gifts (buyers to sellers)

–Price competition

-Examples: Imposing extra fees

-Illegal price cutting by sellers

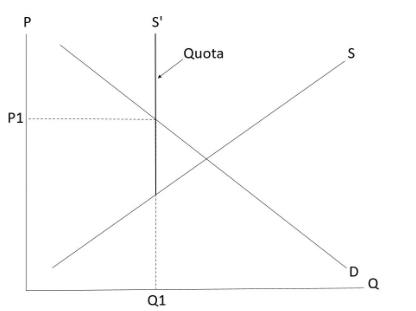

Quota

-A maximum quantity supplied of a good allowed by the government/by law.

-Effective only when it is imposed below the equilibrium quantity. (i.e.畫係equilibrium point嘅左邊)

-When the quota is set above the equilibrium quantity (畫左係equilibrium嘅右邊→ineffective), price and quantity transacted will remain at the equilibrium level.

-Example: Import/export quota

|

Price |

P1 |

|

Quantity transacted |

Q1 |

|

Total expenditure/revenue |

P1 x Q1 |

Point to note

-The effect on total expenditure/revenue due to a rise in price (caused by an effective quota) should be uncertain, depending on the elasticity of demand.

Effect on quality under quota

-As a quota would restrict the quantity of a good allowed to be sold, some producers will thus decide to improve their product quality to increase their competitiveness. Therefore, the average quality of the good under quota will increase.

-If an effective quota on a good is removed, the average quality of the good will thus deteriorate.

Summary on the effects of an effective quota

-Price↑

-Quantity transacted↓

-Total expenditure/revenue ?

-Improvement in average quality of goods

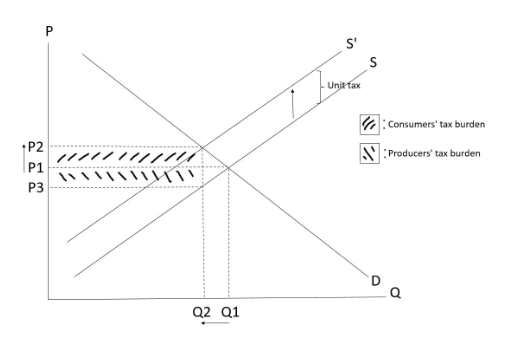

Unit tax

-Levied on every unit of output.

-Not the same as Ad valorem tax (percentage tax) which is a certain percentage of the price of a good.

Effects of a unit tax

-After the imposition of a unit tax on producers, the cost of production of producers will increase which will lead to a decrease in supply.

Point to note

-When drawing the arrow indicating the drop in supply, it should be drawn as an arrow pointing upward.

|

Original price |

P1 |

|

Price after tax = Price actually paid by consumers = Market price |

P2 |

|

Per unit revenue after tax = Price actually received by producers |

P3 |

|

Quantity transacted |

Q2 |

|

Consumers’ total expenditure |

P2 x Q2 |

|

Producers’ total revenue net of tax |

P3 x Q2 |

Consumers’ total expenditure

=Total revenue (received by producers) inclusive of tax

=Total revenue (received by producers) net of tax + total tax payment

-The change in consumers’ total expenditure should be uncertain after the imposition of a unit tax, depending on the elasticity of demand.

Producers’ total revenue net of tax

=Consumers’ total expenditure – total tax payment

=Price actually received by producers x new quantity transacted

= (New equilibrium price (P2) – Unit tax) x new quantity transacted

-Producers’ total revenue net of tax must decrease under any elasticity of demand after a unit tax is imposed as both quantity transacted, and price actually received by producers drop.

Distribution of tax burden

Total tax burden/total tax payment/total tax revenue received by government

=Consumers’ tax burden + producers’ tax burden

=Unit tax x new quantity transacted

= (P2 – P3) x Q2

Consumers’ tax burden

=Unit tax borne by consumers x new quantity transacted

= (P2 – P1) x Q2

-對於consumers黎講,比多D錢就係佢地嘅burden。

Producers’ tax burden

=Unit tax borne by producers x new quantity transacted

= (P1 – P3) x Q2

-對於producers黎講,收小D錢就係佢地嘅burden。

Summary

|

Consumers食多D |

Ed<Es |

|

Producers食多D |

Es<Ed |

|

一樣食咁多 |

Ed = Es |

越inelastic食越多,越elastic食越小

Extreme cases

|

Consumers食曬 |

Producers食曬 |

|

Perfectly inelastic demand |

Perfectly elastic demand |

|

Perfectly elastic supply |

Perfectly inelastic supply |

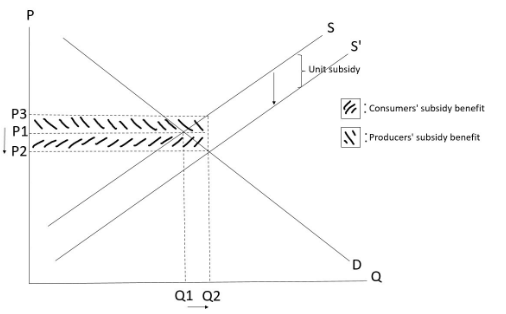

Unit subsidy

-Granted for each unit of output.

-Not the same as Ad valorem subsidy (percentage subsidy) which is a certain percentage of the price of a good.

Effects of a unit subsidy

-After the imposition of a unit subsidy on producers, the cost of production of producers will decrease which will lead to an increase in supply.

Point to note

-When drawing the arrow indicating the increase in supply, it should be drawn as an arrow pointing downward.

|

Original price |

P1 |

|

Price after subsidy = Price actually paid by consumers = Market price |

P2 |

|

Per unit revenue after subsidy = Price actually received by producers |

P3 |

|

Quantity transacted |

Q2 |

|

Consumers’ total expenditure |

P2 x Q2 |

|

Producers’ total revenue including subsidy |

P3 x Q2 |

Consumers’ total expenditure

=Producers’ total revenue excluding subsidy

-The change in consumers’ total expenditure should be uncertain after the imposition of a unit subsidy, depending on the elasticity of demand.

Producers’ total revenue including subsidy

=Consumers’ total expenditure + total amount of subsidy granted

=Price actually received by producers x new quantity transacted

= (New equilibrium price (P2) + Unit subsidy) x new quantity transacted

-Producers’ total revenue including subsidy must increase under any elasticity of demand after a unit subsidy is imposed as both quantity transacted, and price actually received by producers increase.

Distribution of subsidy

Total amount of subsidy granted (by government)

=Consumers’ subsidy benefit + producers’ subsidy benefit

=Unit subsidy x new quantity transacted

= (P3 – P2) x Q2

Consumers’ subsidy benefit

=Unit subsidy enjoyed by consumers x new quantity transacted

= (P1 – P2) x Q2

-對於consumers黎講,比小D錢就係佢地嘅benefit。

Producers’ tax burden

=Unit subsidy enjoyed by producers x new quantity transacted

= (P3 – P1) x Q2

-對於producers黎講,收多D錢就係佢地嘅benefit。

Summary

|

Consumers享受多D |

Ed<Es |

|

Producers享受多D |

Es<Ed |

|

一樣享受咁多 |

Ed = Es |

越inelastic享受越多,越elastic享受越小

Extreme cases

|

Consumers享受曬 |

Producers享受曬 |

|

Perfectly inelastic demand |

Perfectly elastic demand |

|

Perfectly elastic supply |

Perfectly inelastic supply |

如果大家有什麼補習問題,如私人補習、網上補習好唔好,歡迎你可以隨時再跟我多交流一下,可以Follow 「學博教育中心 Learn Smart Education」 Facebook page同IG得到更多補習課程資訊,亦都可以上我們的補習網頁了解更多!

DSE Econ 文章系列

Microeconomics

Macroeconomics

- 經濟表現的量度 Measure of economic performance

- 國民收入決定及價格水平 National income determination and price level

- 貨幣與銀行 Money and Banking

- 宏觀經濟問題和政策 Macroeconomic Problems and policies

- 國際貿易和金融 International Trade and Finance