相信有選修Econ的同學都知道Firms and Production這一課是最多內容需要背誦的課題。

覺得課本太冗長,溫習時不知該從何入手?

想要一份包含所有Firms and Production內容的精讀?

那麼,你就一定不能錯過這篇文章。

學博小編為大家整合了Firms and Production的整合精讀內容,幫你節省時間。

Public ownership

Firms owned by the government are called public enterprises. They are under public ownership.

There are two major forms of public ownership:

|

Public ownership |

Government departments |

Public corporation |

|

Definition |

A unit of governmental organization. |

A firm which is wholly owned by the government, but it is not a unit of governmental organization but is incorporated by the statute.

|

|

Owner |

The government |

The government |

|

Managed by |

Government officials. |

A board of directors appointed by the government. |

|

Staff |

Mostly civil servants. |

Most are non-civil servants. |

|

Financed by |

The government. |

Financially independent of the government. |

|

Objectives |

To provide public services for a low or no price. |

To provide specific public services according to commercial principles. |

|

Examples |

Water Supplies Department/Housing Department/Hong Kong Post |

Airport Authority/Hong Kong Science/Technology Parks Corporation |

Private ownership

Firms owned by private individuals are called private enterprises. They are under private ownership.

There are two major forms of private ownership, owners who bear unlimited liability and owners who bear limited liability.

|

Unlimited liability |

Limited liability |

|

Sole proprietorships Partnerships |

Limited companies: ² Private limited companies ² Public limited companies (Listed companies) |

Unlimited liability

It means that owners’ liability is not confined to the amount of their investment in the firm, meaning that they may have to use their own assets or personal property to repay the debts that the firm incurs.

Limited liability

It means that owners’ liability is confined to the amount of their investment in the firm, meaning that they don’t have to use their own assets or personal property to repay the debts that the firm incurs.

Legal entity

A firm that is a legal entity has an independent legal status, it has a separate legal existence from its owners, and assumes all responsibilities, meaning that:

- the firm can own property, make contracts, and engage in lawsuits under its own name.

- the firm is fully responsible or its debts

- the firm can continue to exist irrespective of ownership transfer, bankruptcy, or death of its owners.

If a firm is a legal entity, its owners bear limited liability.

If a firm is not a legal entity, its owners bear unlimited liability.

Summarized features of the four types of private enterprises

|

|

Unlimited liability |

Limited liability |

||||

|

Sole proprietorship |

Partnership |

Private limited company |

Public limited company |

|||

|

Number of owners |

1 |

2-unlimited |

1 – 50 |

1-unlimited |

||

|

Legal status |

Not a legal entity |

A legal entity |

||||

|

Continuity |

Lack of continuity |

Lasting continuity |

||||

|

Set-up procedure |

Simple and cheap |

Complicated and expensive |

||||

|

Sources of capital |

Narrower |

Wider |

Wider |

Widest |

||

|

Separation of ownership and management |

No |

Yes |

||||

|

Specialization in management |

No |

Yes |

No |

Yes |

||

|

Willingness to improve efficiency |

Stronger |

Weaker |

||||

|

Flexibility in decision making |

Higher |

Lower |

Lower |

|||

|

Relationship with employees and customers |

Closer |

Distant |

||||

|

Disclosure of financial accounts |

No need to disclose |

No need to disclose |

Need to disclose |

|||

|

Transfer of ownership |

Free |

Need consent |

Need consent |

Free |

||

|

Profit tax rate |

Lower |

Higher |

||||

Sole proprietorship vs Partnership

Sole proprietorship

It has only one owner and the owner is called a sole proprietor.

Partnership

It has two or more owners, and the owners are called partners.

|

|

Sole proprietorship |

Partnership |

|

Similarities |

1. Simple and inexpensive set-up procedure 2. No separate legal status 3. Unlimited liability 4. Lack of continuity 5. No separation of ownership and management 6. Stronger incentive to improve efficiency 7. Closer relationship with employees and customers 8. No need to disclose financial accounts 9. Lower profit tax rate (than private and public limited company) |

|

|

Differences |

|

|

|

1. Source of capital |

Narrower source of capital |

Wider source of capital |

|

2. Scope of specialization |

Narrower scope of specialization |

Wider scope of specialization |

|

3. Decision-making |

Higher risk but more flexible in decision making |

Lower risk but less flexible in decision making |

|

4. Transfer of business |

Freely transferable |

More difficult to transfer its business |

|

5. Sharing of costs, risks and profits |

More difficult to transfer its business |

Partners can share the costs, risks, and profits |

Private limited company vs Public limited company

Limited companies

They are private enterprises whose owners bear limited liability. The owners of a limited company are called shareholders.

|

|

Private limited company |

Public limited company |

|

Similarities |

1. Complicated and costly set-up procedures 2. Separate legal status 3. Limited liability 4. Lasting continuity 5. Separation of ownership and management 6. Higher profits tax rate |

|

|

Differences |

|

|

|

1. Number of owners |

1-50 shareholders |

1-unlimited number of shareholders |

|

2. Issue of shares |

Can issue shares but cannot invite the public for subscription |

Can issue shares and can invite the public for subscription |

|

3. Transfer of shares |

Need to seek approval from the board of directors |

Shares are freely transferable |

|

4. Disclosure of financial accounts |

No need to disclose its financial accounts to the public |

(Need to submit its audited annual financial accounts to the Companies Registry.)

The financial accounts are then available and disclosed to the public |

Shares and bonds

Shares

A certificate of ownership issued by a company which entitle its holder to a share of the company’s profits.

Bonds/debentures

A certificate of debt that entitles its holder to earn interest until redemption on the maturity date.

Comparison between shares and bonds

|

|

Shares |

Bonds |

|

Roles of holders |

Owners of a company |

Creditors of a company |

|

Voting rights of holders |

Usually have voting rights at shareholders’ meetings |

Do not have voting rights at shareholders’ meeting |

|

Feature of returns |

1. Shareholders receive dividends 2. Dividends may not be distributed 3. Dividends vary with the e company’s profits and dividend policy |

1. Bondholders receive interest 2. Interest must be paid 3. Interest is usually fixed, whether the company earns a profit or not, interest has to be paid 4. Lower risk due to stable return |

|

Maturity |

No maturity dates |

Redeemed on maturity dates |

|

Priority in getting back capital upon liquidation |

Shareholders are the last to get back their capital |

Bondholders can get back their capital before shareholders |

Comparison between issuing shares and issuing bonds

|

Features |

Issuing shares |

Issuing bonds |

|

Interest burden |

No |

Yes |

|

Redemption obligation |

No |

Yes |

|

Debt-to-equity ratio |

Decrease, as it is easier to borrow new loans |

Increase, as it is more difficult to borrow new loans |

|

Influence on the company’s decisions |

New shareholders may influence the company’s decisions and the existing shareholders’ control right over the company is diluted |

Bondholders have no influence on the company’s decisions |

|

Risk of being taken over |

Increase |

No influence |

Comparison between buying shares and buying bonds

|

Features |

Buying shares |

Buying bonds |

|

Voting rights |

Yes |

No |

|

Rate of return |

May have a higher rate of return if the company earns more profits

Yet, a lower rate of return may be resulted if the company earns less profits or even suffer losses |

May have a higher rate of return if the company earns less profit or suffer losses

Yet, a lower rate of return may be resulted if the company earns a lot of profit |

|

Priority in getting capital refund upon liquidation |

Lower priority than bondholders |

Higher priority than shareholders |

|

Risk of investment |

Higher risk due to unstable income |

Lower risk due to stable income |

Priority of payment upon liquidation of a limited company

Secured creditors (e.g., the bank with its mortgage) →Liquidator→Government and employees→Unsecured creditors (e.g., bondholders)→Shareholders

Classification of outputs

Goods

Tangible outputs of production.

- Examples: books, food, drinks

Services

Intangible outputs of production.

- Examples: transportation, banking

Consumer goods

Goods used to directly satisfy human wants.

- Examples: textbook bought by students for acquiring knowledge

Producer/capital goods

Goods used to help (further) production.

- Examples: textbooks used by teachers for teaching

Private goods

Rival(rous) in consumption: one’s consumption of the good would reduce the amount available for others’ consumption.

Excludable in consumption: one can exclude or prevent non-payers from consuming the good at an affordable cost.

- Examples: apples sold in a market

Public goods

Non-rival(rous) in consumption: one’s consumption of the good would not reduce the amount available for others’ consumption.

Non-excludable in consumption: it is very costly to exclude or prevent nonpayers from consuming the good.

- Examples: fireworks displayed in public area

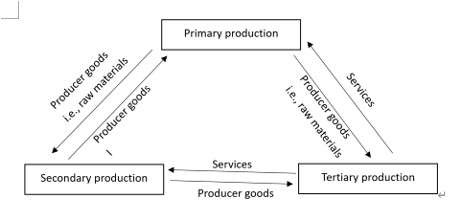

Types of production

Primary production

Activities which extract or directly use natural resources.

- Examples: mining, fishing, farming

Secondary production

Activities which turn raw materials into semi-finished products or finished products.

- Examples: construction, factory work

Tertialry production

Activities which provide services.

- Examples: banking, education, transportation

Relationship between the three types of production

Types of division of labour

|

Simple division of labour |

Different workers specialize in producing different goods. |

A driver specializes in driving; a baker specializes in baking |

|

Complex division of labour |

Different workers specialize I different production stages of the same good or play different roles in teamwork |

In one school, teachers specialize in teaching, the principal focuses on management and the accounting clerk concentrates on accounting duties. |

|

Reginal division of labour |

Workers in different regions specialize in producing different goods or different production stages of the same good. |

In the production of iPhone, the Us specializes in product design, and China specialize in manufacturing. |

Advantages and disadvantages of division of labour

|

Advantages |

Disadvantages |

|

1. Increase labour productivity for the following reasons: A. Assign the most suitable person to do the right job B. Practice makes perfect C. Save time training and moving between tasks D. More workers have capital goods to use E. Stimulate mechanization 2. Raise capital productivity 3. Raise living standards |

1. Work becomes boring 2. Loss of job satisfaction 3. Limited skills of workers 4. Greater skills of unemployment 5. Over-interdependence 6. Excessive standardization of products |

Factors restricting the extent of division of labour

Size of market

Market size↓→ Extent of division of labour↓

Nature of product

Production that requires individual creativity → extent of division of labour↓

Factors of production

|

|

Meaning |

Factor income/return |

|

Entrepreneurship |

Human effort provided by an entrepreneur in making production decisions and bearing risks |

Profit |

|

Labour |

Human effort provided by a worker during production including worker’s physical and mental effort |

Wages |

|

Capital |

Man-made resources used to help production |

Interest |

|

Land |

Natural resources that can be used in production

A gift of nature |

Rent |

Different features of capital and land

|

|

Capital |

Land |

|

Features |

1. Man-made resources 2. Human effort is involved 3. Capital formation/investment involves giving up present consumption for more future consumption 4. The amount can be increased to raise the productivity of other factors or to replace them

|

1. Natural resources 2. No human effort is involved 3. Its creation involves zero cost 4. Its supply cannot be increased artificially |

Labour supply

= Total number of working hours

= Number of workers x Average working hours of workers

Factors affecting labour supply

- Population size↑

- Working condition↑

- Minimum working age ↓

- Retirement age↑

- Years of schooling or training↓

- Attractions for immigration ↑ or restrictions↓

→Number of workers↑

→Labour supply↑

- Number of public holidays↓

- Number of days of annual leave and sick leave↓

- Maximum working hours ↑

→Average working hours↑

→Labour supply↑

Labour productivity

=𝑇𝑜𝑡𝑎𝑙 𝑜𝑢𝑡𝑝𝑢𝑡 / 𝑇𝑜𝑡𝑎𝑙 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑤𝑜𝑟𝑘𝑖𝑛𝑔 ℎ𝑜𝑢𝑟𝑠

=𝑇𝑜𝑡𝑎𝑙 𝑜𝑢𝑡𝑝𝑢𝑡 / 𝐿𝑎𝑏𝑜𝑢𝑟 𝑠𝑢𝑝𝑝𝑙𝑦

Factors affecting labour productivity

|

Factor |

Scenario |

|

Health of workers |

Better health → Labour productivity↑ |

|

Education and training |

More/better education and training → Labour productivity↑ |

|

Incentive to work |

Higher incentive to work → Labour productivity↑ |

|

Capital and technology |

Better use of capital and technology → Labour productivity↑ |

|

Management |

Better management → Labour productivity↑ |

|

Working environment |

More decent working environment → Labour productivity↑ |

Mobility of labour

|

|

Occupational mobility of labour |

Geographical mobility of labour |

|

Meaning |

The willingness and ease of labour to change from one occupation to another |

The willingness and ease of labour to move from one working area to another |

|

Examples |

The willingness and wish of a cook to change his job to become a teacher |

The willingness and wish of a teacher to shift from a school in Kowloon to a school in New Territory |

Factors affecting occupational mobility

|

Factor |

Scenario |

|

Remuneration and working conditions |

Better remuneration and working conditions → occupational mobility ↑ |

|

Entrance requirements |

Relaxing entrance requirements → occupational mobility ↑ |

|

Retraining programmes |

More retraining programmes → occupational mobility ↑ |

|

Market information |

More transparent market information → occupational mobility ↑ |

|

Cost of changing job |

Higher salary of the current job → have to forgo more income if change job → occupational mobility ↓ |

|

Extent of division of labour/specialization |

Higher extent of division of labour/specialization → occupational mobility ↓ |

Factors affecting geographical mobility

|

Factor |

Scenario |

|

Economic, political, and social conditions of different regions |

Better economic, political, and social conditions → geographical mobility ↑ |

|

Immigration policies |

Relaxing immigration policies → geographical mobility ↑ |

|

Transport network and transport cost |

Better transport network and lower transport cost →geographical mobility↑ |

|

Market information |

More transparent market information → geographical mobility ↑ |

Methods of wage payment

Piece rate

Workers are paid according to the amount of their output.

|

Advantages |

Disadvantages |

|

|

To employers |

Raising workers’ incentive to work and labour productivity Lower cost of monitoring workers’ performance |

Higher cost of calculating wage payments Higher cost of monitoring product quality |

|

To employees |

Possible to get higher income |

Unstable income |

Time rate

Workers are paid based on their working hours.

|

Advantages |

Disadvantages |

|

|

To employers |

Lower cost of monitoring product quality Lower cost of calculating wage payments |

Lowering workers’ incentive to work and labour productivity Higher cost of monitoring workers’ performance |

|

To employees |

Stable income |

Cannot ear more money by working faster |

Profit-sharing scheme/commission (usually with a basic salary)

A portion of the firm’s profit (or sales revenue) is distributed to workers as a wage payment.

|

Advantages |

Disadvantages |

|

|

To employers |

Raising workers’ incentive to work and labour productivity Lower cost of monitoring workers’ performance Transferring some business risks to workers |

Higher cost of calculating wage payments More difficult to recruit workers |

|

To employees |

Possible to get higher income |

Unstable income |

Tips

A gift of money paid by customers to reward workers.

|

|

Advantages |

Disadvantages |

|

To employers |

² Raising workers’ incentive to work ² Lower cost of monitoring workers’ performance |

² Higher cost of calculating wage payments ² More difficult to recruit workers |

|

To employees |

² Possible to get higher income |

² Unstable income |

Comparison between different wage payments

|

|

Piece rate |

Time rate |

Profit-sharing scheme/commission |

Tips |

|

To employers: |

|

|

|

|

|

Workers’ work incentive and productivity |

Higher |

Lower |

Higher |

Higher |

|

Cost of calculating wage payments |

Higher |

Lower |

Higher |

Higher |

|

Cost of monitoring workers’ performance |

Lower |

Higher |

Lower |

Lower |

|

Cost of monitoring product quality |

Higher |

Lower |

Lower |

Lower |

|

Ease of recruiting workers |

/ |

/ |

Difficult |

Difficult |

|

Transferring business risk from employers to workers |

/ |

/ |

Part of the business risks can be transferred to workers |

/ |

|

To workers: |

|

|

|

|

|

Possibility of earning a higher income |

Can |

Cannot |

Can |

Can |

|

Income stability |

Unstable |

Stable |

Unstable |

Unstable |

Conditions where a specific type of wage payment is preferred

Piece rate

- It is commonly used in manufacturing industries where:

- workers’ contribution can be easily measured.

- product quality can be easily monitored.

Time rate

- t is commonly used in service industries where:

- workers’ contribution is too costly to measure.

- high quality of work/product is required.

Profit-sharing scheme

- For supervisors and managers whose performance is decisive to the firm’s profit and monitor.

Tips

- For workers who provide direct services to customers.

Capital stock

Change in capital stock

= Capital formation – Capital depreciation

Capital formation (investment)

It is the purchase or production of capital. Investment implies that present consumption is forgone for more future consumption.

Capital deprecation

It is the consumption or disposal of capital.

*The net increase in capital stock is called capital accumulation.

Production cost

|

|

Production costs |

|

|

Variable costs |

Fixed costs |

|

|

Meaning |

Costs which change with output |

Costs which do not change with output |

Production runs/production periods

|

|

Short run |

Long run |

|

Meaning |

Production involving both variable and fixed factors. |

Production involving only variable factors. |

|

Related concepts |

The law of diminishing marginal returns:

When more units of a variable factor are continuously added to a given quantity of fixed factors, the marginal product of the variable factor will eventually decrease, other factors being constant (including technology).

² MP can decrease after an initial increase. ² MP can decrease initially. |

Economies of scale:

Production scale↑ → Output↑ → Long run average cost↓

Diseconomies of scale:

Production scale↑ → Output↑ → Long run average cost↑

Optimal scale:

The production scale where the long run average cost is the lowest. |

Output calculation in the short run

Average product

= The amount of output produced by a unit of a variable factor on average.

=𝑇𝑃 / 𝑈𝑛𝑖𝑡𝑠 𝑜𝑓 𝑣𝑎𝑟𝑖𝑎𝑏𝑙𝑒 𝑓𝑎𝑐𝑡𝑜𝑟

Total product

= The amount of output produced by a given quantity of a variable factor.

= AP x Units of variable factor

= ∑MP

Marginal product

= The change in total amount of output caused by an additional unit of a variable factor

= TPn – TP(n – 1)

Cost calculation in the long run

Average cost

= The cost of producing a unit of output on average.

=𝑇𝐶 / 𝑈𝑛𝑖𝑡𝑠 𝑜𝑓 𝑜𝑢𝑡𝑝𝑢𝑡

Total cost

= The cost producing a given quantity of output.

= AC x Units of output

Marginal cost

= The change in total cost of producing an additional unit of output.

= TCn – TC(n -1)

Internal economies of scale

When the production scale of a firm expands, the long run average cost decreases.

|

Technical economies |

Large firm can more fully utilize its machines and afford more advanced machines → LRAC ↓ |

|

Managerial economies |

Large firm can apply a wider scope of specialization among its managers and attract better managers → LRAC ↓ |

|

Financial economies |

Large firm may borrow money from banks in a lower interest rate and is easier to issue shares to avoid paying interest → LRAC ↓ |

|

Purchasing economies |

Large firm can buy in bulk and obtain a larger discount → LRAC ↓ |

|

Marketing economies |

Larger firm can spread its advertising costs over a large output → LRAC ↓ |

|

Risk diversification economies |

Large firm can diversify its input sources, products, and markets to spread its risks → LRAC ↓ |

|

Research and development economies |

Large firm can spread its costs on R&D over a larger output → LRAC ↓ |

Internal diseconomies of scale

When the production scale of a firm expands beyond the optimal scale, the long run average cost is raised.

|

Managerial diseconomies |

When a firm keeps expanding, its organization may become too complicated. Decision may thus be delayed, and coordination may be weakened, lowering the managerial efficiency → LRAC ↑ |

|

Financial diseconomies |

If a firm enlarges its scale by borrowing continuously, it may need to pay a higher interest rate to obtain capital since it is too risky for a bank to lend too much money to the same firm → LRAC ↑ |

|

Purchasing diseconomies |

A continuously expanding firm may have to purchase more expensive resources or use more expensive substitutes → LRAC ↑ |

|

Marketing diseconomies |

If a firm keeps expanding, existing markets may approach saturation. The firm thus need to pay a higher marketing cost develop new markets or promote new products → LRAC ↑ |

External economies of scale

When an industry becomes larger, the long run average cost decreases.

|

Lower cost of recruiting and training workers |

More workers would be attracted to the industry, employed, and trained. Thus, more experienced, and qualified workers will be available in the industry, lowering firm’s costs of recruiting and training workers → LRAC ↓ |

|

Lower cost of marketing and promotion |

More people will know about the industry’s products, lowing the firm’s costs of marketing and promotion→ LRAC ↓ |

|

Lower cost of buying backup services |

More related businesses will be developed, lowering the firm’s costs of buying back-up services → LRAC ↓ |

|

Lower transportation cost |

Due to concentration of shops, goods can be delivered to shops more easily → LRAC ↓ |

|

Sharing of technology and production facilities |

Production facilities, resources, technology and inventories can be shared among firms → LRAC ↓ |

External diseconomies of scale

When an industry becomes larger, the long run average cost increases.

|

Increase in input prices |

Excessive expansion of firms creates a huge demand for inputs, rising input prices, increasing the production cost → LRAC ↑ |

|

Saturation of existing market |

Firms may need to develop new markets or promote new products, increasing the marketing costs → LRAC ↑ |

|

Increase in the cost of using back-up services |

Higher demand for back-up services would increase the cost of these services → LRAC ↑ |

|

Heavy traffic and congestion |

Concentration of firms may lead to heavy traffic flow and congestion, increasing the transportation cost→ LRAC ↑ |

Expansion of firms

Internal expansion

It is the expansion of a firm on its own, e.g., setting up a new branch on its own.

External expansion/integration

It is the expansion of a firm by combining with another firm, e.g., by taking over another firm.

The four types of expansion

|

|

Horizontal expansion |

Vertical expansion |

Lateral expansion |

Conglomerate expansion |

|

|

Vertical backward expansion |

Vertical forward expansion |

||||

|

Meaning |

At the same production stage of the same product |

At different production stages of the same product |

Of related but not competing products |

Of unrelated products |

|

|

At a preceding stage |

At a later stage |

||||

|

Example: (Textbook factory) |

Another textbook factory |

Paper making factory |

Bookstore |

Magazine factory |

Coffee shop |

Motives for the four types of expansion

|

Horizontal expansion |

Vertical expansion |

Lateral expansion |

Conglomerate expansion |

|

Enjoy economies of scale |

|||

|

More efficient use of resources |

|||

|

Increase market share

Reduce competition (for external expansion only) |

Make use of its brand name to sell other products |

||

|

Backward: Secure the supply of inputs

Forward: Secure market outlets for outputs |

Spread risk through products diversification |

||

Market structure

Features of different market structures

|

Features |

Perfect competition |

Imperfect competition |

||

|

Monopolistic competition |

Oligopoly |

Monopoly |

||

|

Number of sellers |

Many small sellers |

A few dominant sellers with or without many small sellers |

Only one seller |

|

|

Ease of entre |

Free entry |

Not easy |

No entry |

|

|

Nature of products |

Homogeneous |

Heterogeneous |

Can be homogeneous or heterogeneous |

No close substitutes |

|

Availability of market information to buyers & sellers |

Perfect information |

Imperfect information |

||

|

Other features |

Price takers (only one price in the market) Does not engage in non-price competition |

Price searcher (more than one price in the market) |

||

|

Engage in both price and non-price competition |

Interdependent in pricing policies Prices tend to be rigid but sometimes a price war may occur Price leadership may exist Non-price competition is common |

Engage in both price and nonprice competition |

||

Sources of monopoly power

- Sole ownership of essential resources or techniques required in production

- Sole ownership of patents or copyrights

- Sole ownership of franchise

- Government monopoly

- Natural monopoly: A market allows no room for more than one firm to exist as the set-up cost is extremely high, only the largest/the first firm in the market can enjoy the lowest average cost, thus driving competitors out of the market and becoming a natural monopoly.

- Integration or collusion

Major objectives of private enterprises

- Profit maximization

- Market share maximization

- Corporate social responsibility

- Provision of non-profitmaking goods and services

Calculation related to profit-maximizing

Profit-maximizing output

It is the output at which a firm can maximize its profit

Marginal revenue (MR)

= TRn – TR(n-1)

Marginal cost (MC)

= TCn – TC(n-1)

Profit maximizing condition

P(MR) = MC

Calculation of profit

Profit = Total revenue – Total cost

= (P x Q) – (TVC + TFC)

= (P x Q) – (AVC x Q + TFC)

= (P x Q) – (∑MC + TFC)

= PS -TFC

= (TR – TVC) – TFC

*P = Price, Q = units of output, TVC = Total variable cost, TFC = Total fixed cost,

AVC = Average variable cost, MC = Marginal cost, PS = Producer surplus, TR = Total revenue

Change in profit under different conditions

- When P↑ → Profit↑

- When TFC↑ → Profit↓

- When MC↑ → Profit↓

*A price-taking firm’s marginal cost schedule is its supply curve.

如果大家有什麼補習問題,如私人補習、網上補習好唔好,歡迎你可以隨時再跟我多交流一下,可以Follow 「學博教育中心 Learn Smart Education」 Facebook page同IG得到更多補習課程資訊,亦都可以上我們的補習網頁了解更多!

DSE Econ 文章系列

Microeconomics

Macroeconomics

- 經濟表現的量度 Measure of economic performance

- 國民收入決定及價格水平 National income determination and price level

- 貨幣與銀行 Money and Banking

- 宏觀經濟問題和政策 Macroeconomic Problems and policies

- 國際貿易和金融 International Trade and Finance